You’re more essential than you think: it is crunch time for Newfoundland and Labrador employers to avail of Essential Worker Support Program

Ruth Trask and John Samms

Newfoundland and Labrador employers who continued operations this spring during Alert Levels 4 and 5 of the COVID-19 pandemic should take note of a new program offered by the provincial government that may provide extra wage supports.

The federal government pledged up to $3 billion in support to increase the wages of low-income essential workers across the country, leading the Newfoundland and Labrador government to create the Essential Worker Support Program (“EWSP”) to get this support into the hands of workers. You may not be aware of two key things: (1) the term “essential worker” is likely more broad than you expected; and (2) to avail of the program for their employees, employers must act soon.

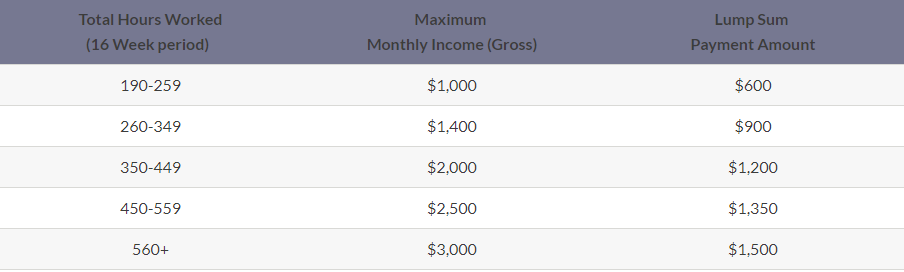

The program provides for a lump sum payment of up to $1,500 for each essential worker who meets the eligibility criteria. The employer must apply on their behalf and upon a successful application, the funds funnel from the government, to the employer, and finally to the employee. Employers are eligible to receive an additional 10 percent of the total employee benefit, which is meant to cover its mandatory employment-related costs such as the employer’s share of CPP and EI remittances.

The eligibility period is for workers who worked from March 15 to July 4, 2020. The eligible benefit amounts are explained as follows on the government webpage:¹

You’re more essential than you think

Newfoundland and Labrador has followed the federal government’s lead in establishing a broad range of “essential” services which qualify for the EWSP program. If your business services fall within this group and you operated during Alert Levels 4 and 5, your business may be able to apply, even if you were operating only at a reduced capacity between March 15 and July 4.

The requirements are that an eligible essential worker must:

- Be a resident of Newfoundland and Labrador and legally authorized to work in Canada;

- Be employed or self-employed in any business or organization providing ‘essential services’ as defined by Essential Worker Listing;

- Have not received the Canadian Emergency Response Benefit (CERB) during the eligibility period;

- Have worked in both Alert Levels 4 and 5;

- Have gross earnings less than $3,000 in a month during the program eligibility period; and

- Have worked a minimum of 190 hours during the program eligibility period.

Importantly, the definition of “essential services” is quite broad, as it is “any business” providing essential services as defined by the Essential Worker Listing in the following sectors:

- Energy and Utilities

- Information and Communication Technologies

- Finance

- Health

- Food

- Water

- Transportation

- Safety

- Government

- Manufacturing

The listing at the link above provides further detailed guidance in relation to those specific sectors. Employers will need to carefully inspect this guidance document to ensure they fit within its parameters, but it is worth considering for most employers who employ eligible employees as described above. Employers are required to certify in a declaration that their employees are eligible for EWSP, which may require you to work with your employees to confirm the necessary information.

It’s crunch time

To avail of this program for your employees, employers should act fast. There is a two-step registration process. First, employers have to register to be set up as a government vendor and then complete one’s registration as an Essential Worker Employer. Government recommended that this portion of the registration process be complete before June 30, 2020, but it is not too late to apply now. Employers should start this process as soon as possible, and be mindful of the ultimate application deadline of July 30, 2020.

We are here to help

The EWSP could provide your employees with much-needed support and compensation for working during the early days of the COVID-19 pandemic, which is positive for employers and workers alike. We encourage you to review the criteria and consider applying if your employees are eligible. We would be pleased to assist you as you navigate the eligibility criteria, making the necessary inquiries of your employees and evaluating your payroll records, and completing the application process.

For more information and for access to the application forms, employers can also consult the government EWSP webpage here.

¹ https://www.gov.nl.ca/aesl/essential-workers-program/

This article is provided for general information only. If you have any questions about the above, please contact a member of our Labour and Employment group.

Click here to subscribe to Stewart McKelvey Thought Leadership articles and updates.

Archive

Grant Machum Last week’s Nova Scotia Court of Appeal’s decision in Halifax Herald Limited v. Clarke, 2019 NSCA 31, is good news for employers. The Court overturned the trial judge’s determinations that an employee had…

Read MoreRick Dunlop On April 24, 2019, the Nova Scotia Government created the Trade Union Act General Regulations so that the Labour Board will no longer consider a Saturday, Sunday, or holiday as the date of…

Read MoreRodney Zdebiak and Anthony Granville On Monday, April 15, 2019, the Newfoundland and Labrador legislature passed a number of changes to the Automobile Insurance Act (“Act”) stating that the intent is to help stabilize insurance rates,…

Read MoreGrant Machum and Richard Jordan Employers carefully safeguard customer or client lists as confidential information. Gone are the days, however, where an employer’s customer list is only found in a Rolodex or in a closed…

Read MoreGrant Machum and Guy-Etienne Richard Maintaining employment files requires physical space and can be costly. Nowadays many employers are moving away from keeping paper files to electronic storage. This brings up two issues: Are employers…

Read MoreLevel Chan and Dante Manna On March 12, 2019, the Nova Scotia legislature introduced long anticipated amendments to the Pension Benefits Act (“PBA”) which, according to a statement by Finance Minister Karen Casey, are aimed…

Read MoreJulia Parent and Graham Haynes In the long-awaited decision in the case of Orphan Well Association v Grant Thornton Ltd, the Supreme Court of Canada held that end-of-life environmental cleanup obligations imposed by Alberta’s provincial…

Read MoreIn preparing for the 2019 proxy season, you should be aware of some regulatory changes and institutional investor guidance that may impact disclosure to, and interactions with, your shareholders. This update highlights what is new…

Read MoreChad Sullivan and Bryan Mills New Brunswick has recently introduced a new regulation under the Occupational Health and Safety Act on the topic of problematic workplace conduct. The change will bring New Brunswick in line…

Read MoreJennifer Taylor In an important decision for the auto insurance industry, the Nova Scotia Court of Appeal has confirmed that future CPP disability benefits are indeed deductible from damages awarded in Nova Scotia cases for…

Read More