You’re more essential than you think: it is crunch time for Newfoundland and Labrador employers to avail of Essential Worker Support Program

Ruth Trask and John Samms

Newfoundland and Labrador employers who continued operations this spring during Alert Levels 4 and 5 of the COVID-19 pandemic should take note of a new program offered by the provincial government that may provide extra wage supports.

The federal government pledged up to $3 billion in support to increase the wages of low-income essential workers across the country, leading the Newfoundland and Labrador government to create the Essential Worker Support Program (“EWSP”) to get this support into the hands of workers. You may not be aware of two key things: (1) the term “essential worker” is likely more broad than you expected; and (2) to avail of the program for their employees, employers must act soon.

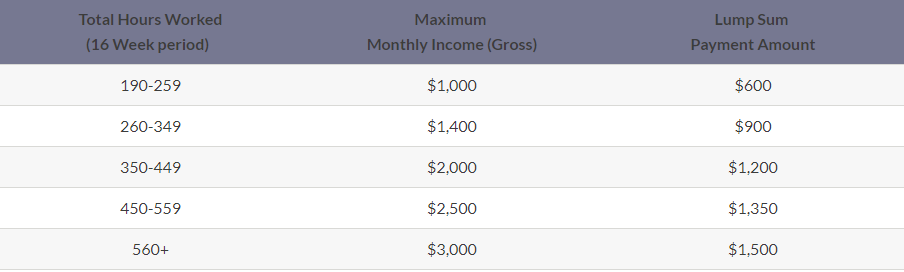

The program provides for a lump sum payment of up to $1,500 for each essential worker who meets the eligibility criteria. The employer must apply on their behalf and upon a successful application, the funds funnel from the government, to the employer, and finally to the employee. Employers are eligible to receive an additional 10 percent of the total employee benefit, which is meant to cover its mandatory employment-related costs such as the employer’s share of CPP and EI remittances.

The eligibility period is for workers who worked from March 15 to July 4, 2020. The eligible benefit amounts are explained as follows on the government webpage:¹

You’re more essential than you think

Newfoundland and Labrador has followed the federal government’s lead in establishing a broad range of “essential” services which qualify for the EWSP program. If your business services fall within this group and you operated during Alert Levels 4 and 5, your business may be able to apply, even if you were operating only at a reduced capacity between March 15 and July 4.

The requirements are that an eligible essential worker must:

- Be a resident of Newfoundland and Labrador and legally authorized to work in Canada;

- Be employed or self-employed in any business or organization providing ‘essential services’ as defined by Essential Worker Listing;

- Have not received the Canadian Emergency Response Benefit (CERB) during the eligibility period;

- Have worked in both Alert Levels 4 and 5;

- Have gross earnings less than $3,000 in a month during the program eligibility period; and

- Have worked a minimum of 190 hours during the program eligibility period.

Importantly, the definition of “essential services” is quite broad, as it is “any business” providing essential services as defined by the Essential Worker Listing in the following sectors:

- Energy and Utilities

- Information and Communication Technologies

- Finance

- Health

- Food

- Water

- Transportation

- Safety

- Government

- Manufacturing

The listing at the link above provides further detailed guidance in relation to those specific sectors. Employers will need to carefully inspect this guidance document to ensure they fit within its parameters, but it is worth considering for most employers who employ eligible employees as described above. Employers are required to certify in a declaration that their employees are eligible for EWSP, which may require you to work with your employees to confirm the necessary information.

It’s crunch time

To avail of this program for your employees, employers should act fast. There is a two-step registration process. First, employers have to register to be set up as a government vendor and then complete one’s registration as an Essential Worker Employer. Government recommended that this portion of the registration process be complete before June 30, 2020, but it is not too late to apply now. Employers should start this process as soon as possible, and be mindful of the ultimate application deadline of July 30, 2020.

We are here to help

The EWSP could provide your employees with much-needed support and compensation for working during the early days of the COVID-19 pandemic, which is positive for employers and workers alike. We encourage you to review the criteria and consider applying if your employees are eligible. We would be pleased to assist you as you navigate the eligibility criteria, making the necessary inquiries of your employees and evaluating your payroll records, and completing the application process.

For more information and for access to the application forms, employers can also consult the government EWSP webpage here.

¹ https://www.gov.nl.ca/aesl/essential-workers-program/

This article is provided for general information only. If you have any questions about the above, please contact a member of our Labour and Employment group.

Click here to subscribe to Stewart McKelvey Thought Leadership articles and updates.

Archive

By Peter McLellan, QC In the 1970s the issue for employers was long hair and sideburns. In the 1980’s it was earrings for men. Today the employer’s concerns are with tattoos and facial piercings. What are…

Read MoreBy Jennifer Taylor Introduction It sounds simple: Two disputing parties, hoping to resolve their disagreement without drawn-out court proceedings, will mutually agree to a settlement on clear terms; release each other from all claims; and move…

Read More2015 ends with changes in workplace laws that our region’s employers will want to be aware of moving into 2016. Some legislation has been proclaimed and is in force, some has passed and will be…

Read MoreThe Island Regulatory and Appeals Commission (the “Commission”) has issued a holiday reminder to municipalities in Prince Edward Island about the importance of preparation, accuracy, and transparency when making decisions related to land use and…

Read MoreBy Brian G. Johnston, QC On the same day that the Nova Scotia government announced its projected deficit had ballooned to $241 million, it also introduced Bill 148, the Public Services Sustainability (2015) Act (“Act”). The stated purposes…

Read MoreBy Jennifer Taylor – Research Lawyer Nova Scotia’s Cyber-safety Act1 is no more, after a successful Charterchallenge to the legislation. In Crouch v Snell, 2015 NSSC 340, Justice McDougall of the Supreme Court of Nova Scotia found the entire statute—enacted in…

Read MoreBy Jennifer Taylor Introduction: Did Ontario have jurisdiction? Arguments about access to justice are not enough to oust the general principles of jurisdiction, according to a recent Ontario case. In Forsythe v Westfall, 2015 ONCA 810, the…

Read MorePART I: THE NSCA DECISION IN BRINE “Disability insurance is a peace of mind contract”: that’s the opening line of the Nova Scotia Court of Appeal’s long-awaited decision in Industrial Alliance Insurance and Financial Services Inc…

Read MoreThe taxation of estates, testamentary trusts and certain “life interest trusts” such as alter ego, joint partner and spousal trusts, and the rules for charitable donations made on death through an estate are changing significantly…

Read MoreSeveral important changes in the tax rules that apply to charitable gifts will be coming into effect in the near future. Some of the new rules take effect in 2016, and others will apply beginning…

Read More