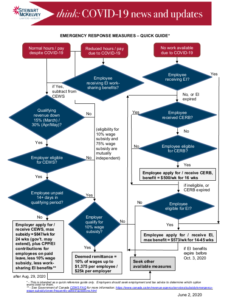

Taking stock: Quick reference guide for government initiatives

*Flowchart below last updated June 2, 2020 (Originally published April 14, 2020)

With the passing of Bill C-14, the COVID-19 Emergency Response Act, No. 2 on April 11, 2020, the federal government has now laid a legislative foundation for various initiatives to assist employers and employees who are affected by COVID-19. The main measures include:

- The new Canada Emergency Response Benefit (“CERB”)

- The new Canada Emergency Wage Subsidy (“CEWS”), a 75% wage subsidy for eligible employers for the 12-week period beginning March 15, 2020

- The new 10% Temporary Wage Subsidy for employers

- Enhanced access to Employment Insurance (“EI”) benefits, including streamlining applications to the EI work-sharing program

Details on emergency response measures have shifted over the past few weeks, as they have evolved in response to our ever-changing situation. We expect this evolution will continue in many respects; notably, we are still awaiting regulations to further clarify some details related to CERB and CEWS.

However, given that the legislation now appears to be place, it seems an opportune moment for a fresh look at the current landscape of options. Recognizing it is a busy time, it is our pleasure to provide a dynamic summary of the mutual interactions between CERB, CEWS, EI and the 10% wage subsidy. We trust this will serve as a helpful reference point when seeking employment and tax advice to find the best options in the circumstances.

*Link to printable PDF version here.

This article is provided for general information only. If you have any questions about the above, please contact a member of our Labour and Employment group.

Click here to subscribe to Stewart McKelvey Thought Leadership articles and updates.

Archive

By Jennifer Taylor – Research Lawyer With the federal election just days away, voting is on Canadians’ minds. This will be the first election conducted in accordance with the Fair Elections Act, SC 2014, c 12 [“FEA”] which…

Read MoreBy Jennifer Taylor Introduction There is now a Nova Scotia decision on the interplay between the provincial Builders’ Lien Act and the federal Bankruptcy and Insolvency Act (“BIA”) in the interesting context of trusts. In Re Kel-Greg Homes Inc, Justice Rosinski…

Read MoreThe New Brunswick government is seeking feedback from stakeholders on proposed changes to the Employment Standards Act (“Act”). The proposed changes relate to: – the statutory minimum wage; – employment protections for young workers; and – coverage…

Read MoreOCTOBER 19, 2015 – FEDERAL ELECTION A Federal election has been called for Monday, October 19, 2015. Polls are open in Atlantic Canada from 8:30 a.m. to 8:30 p.m. Advance polls are open from…

Read MoreAs of August 1, 2015, section 4 of the Nova Scotia Automobile Tort Recovery Limitations Regulations was repealed. This section previously set the discount rate for future losses in automobile tort claims at 3.5%. The repeal…

Read MoreOn September 9, 2015, the Nova Scotia Department of Finance and Treasury Board opened a consultation on draft Regulations for Pooled Registered Pension Plans (PRPPs). The draft Regulations and an FAQ are posted online. PRPPs are…

Read MoreBy Jennifer Taylor – Research Lawyer September used to mean one thing: back to school. This year, Nova Scotia lawyers get a fresh learning opportunity of a different sort. It comes in the form of the new Limitation…

Read MoreTHE EDITORS’ CORNER Michelle Black and Sean Kelly Aaah, summer – that long anticipated stretch of lazy, lingering days, free of responsibility and rife with possibility. It’s a time to hunt for insects, master handstands, practice swimming…

Read MoreThe New Public Contracting World As part of an ongoing initiative aimed at ensuring Canada only does business with ethical suppliers, Public Works and Government Services Canada (“PWGSC”) has introduced changes to its Integrity Regime…

Read MoreIn an important case for insurance practice in Nova Scotia, the Court of Appeal has confirmed that the value of future CPP disability benefits is deductible under the SEF 44 family protection endorsement. Justice Scanlan wrote the…

Read More